The Role of Accounting in An Organization

Accounting plays a critical role in helping businesses handle complexity, inform decision-making, and satisfy the various demands of stakeholders and society in the highly competitive business climate of today. Let's examine accounting's many facets and its importance to modern business operation.

There is a saying that accounting is the "language of business." To do this, financial transactions for people, groups, or businesses must be methodically recorded, analysed, and summarized. Providing financial data that supports stakeholders in making educated decisions is accounting's main goal.

Why is accounting so important?

The purpose of accounting

|

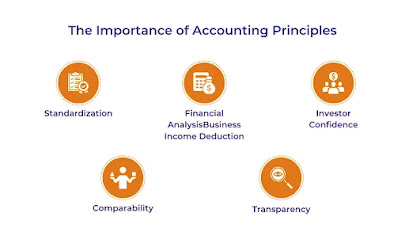

| Importance of Accounting |

Here are some Key purposes:

Recording Financial Transactions: Accounting provides a systematic method to record all financial transactions (revenues, expenses, purchases, sales, etc.). This ensures a clear historical record of business activities, which is essential for tracking performance over time.

Measuring Financial Performance: Accounting aids businesses in evaluating their financial health by producing key financial reports like income statements, balance sheets, and cash flow statements, which are crucial for stakeholders' evaluation.

Facilitating Decision-Making: The financial data generated by accounting helps business owners, managers, and investors make critical decisions about operations, investments, and growth strategies.

Ensuring Legal and Regulatory Compliance: Accounting ensures financial records are maintained in compliance with laws, tax regulations, and accounting standards like GAAP or IFRS, thereby preventing businesses from facing legal penalties.

Tax Preparation and Compliance: Accounting plays a vital role in preparing accurate tax returns and ensuring that a company complies with tax laws. It helps calculate the correct amount of taxes owed and identifies opportunities for tax savings through deductions and credits. (Scott Powell, 2023)

Accounting’s Application in Both Personal and Business Life

Accounting principles and practices are applicable in both personal and business life but with varying scope and complexity.

Here’s how accounting is relevant in each context:

Personal Life

· Budgeting: Accounting helps individuals create a budget by tracking income, expenses, and savings. It ensures that personal finances are managed effectively and that spending does not exceed income.

· Financial Planning: Through accounting, individuals can plan for future financial needs such as education, purchasing a home, vacations, or retirement. It helps set financial goals and allocate resources to achieve them.

· Tax Filing: Personal accounting helps in gathering financial data for preparing and filing accurate tax returns. It ensures that individuals pay the right amount of taxes and take advantage of any deductions or credits.

· Debt Management: By tracking income and expenses, accounting helps individuals manage debts, such as credit cards, student loans, and mortgages, ensuring timely payments and avoiding penalties.(Freshbooks, 2022)

·

Business Life:

· Financial Reporting: Businesses use accounting to prepare financial statements such as income statements, balance sheets, and cash flow statements. These reports are essential for assessing the financial health of the business and meeting regulatory requirements.

· Cost Control: Through accounting, businesses can track operating expenses and find ways to reduce costs without sacrificing quality. This is crucial for maintaining profitability and competitive pricing.

· Tax Compliance: Businesses use accounting to ensure they comply with tax laws and regulations, calculate taxes owed, and file timely tax returns. Proper tax accounting helps avoid legal penalties and maximize tax benefits.

· Budgeting and Forecasting: Like personal life, businesses also use accounting for budgeting and forecasting. It allows businesses to allocate resources effectively and plan for future growth, expansion, or any financial challenges.

· Auditing: Businesses conduct internal and external audits using accounting systems to verify the accuracy of their financial statements and ensure compliance with industry standards and regulations.

How Accounting Helps in Evaluating Business Performance

Profitability Analysis

· Income Statement: The income statement (also called the profit and loss statement) shows the company’s revenues, expenses, and net profit over a specific period. By comparing income with expenses, accounting allows businesses to determine whether they are making a profit or incurring a loss.

· Gross Profit Margin: By calculating gross profit (revenues minus the cost of goods sold), accounting helps businesses evaluate the profitability of their core activities.

Statement of Financial Position: The Statement of Financial Position, commonly known as the Balance Sheet, is a financial statement that summarizes an organization's assets, liabilities, and equity at a specific point in time.

Cost Account: Cost Accounting is a branch of accounting that focuses on recording, analyzing, and managing the costs associated with producing goods or services.

Financial Ratios:

· Profitability Ratios: Ratios such as return on assets (ROA) and return on equity (ROE) use accounting data to assess how efficiently a company uses its resources and equity to generate profits. These ratios offer insights into business efficiency and investment effectiveness.

· Liquidity Ratios: Ratios like the current ratio (current assets divided by current liabilities) and quick ratio help businesses evaluate their ability to meet short-term financial obligations, ensuring enough liquidity to cover expenses.

· Solvency Ratios: Accounting helps calculate solvency ratios, such as the debt-to-equity ratio, which assesses the company’s long-term ability to meet its financial obligations by comparing total liabilities to shareholders' equity.

Efficiency ratios: Efficiency ratios measure a company's use of resources like assets and inventory for revenue generation and operational optimization. Higher ratios indicate better asset utilization and efficient inventory management, providing valuable insights into operational efficiency and resource management.

Turnover ratios: Turnover ratios are efficiency ratios that assess a company's use of assets like receivables and fixed assets to generate revenue, providing crucial insights into a company's operational performance and financial health.(Petra Martinis, 2023)

Cash Flow Analysis

· Cash Flow Statement: This accounting report shows the inflow and outflow of cash in a business over a period, divided into operating, investing, and financing activities. Analyzing cash flow provides insights into how well the company is generating cash to fund operations, pay debts, and invest in growth.

· Operating Cash Flow: By evaluating operating cash flow, accounting helps businesses understand how much cash is being generated from core operations, indicating whether the business can sustain itself without external funding.

Budgeting and Forecasting: Accounting provides essential data for creating budgets and financial forecasts. By comparing actual performance against budgets, businesses can evaluate whether they are on track to meet their financial goals, enabling better decision-making and resource allocation.

Critical Evaluation of the Accounting Function

Decision-making using accounting information

1. Investment Decisions: Accounting information, such as income statements, balance sheets, and cash flow statements, is utilized by investors and management to evaluate a company's profitability, liquidity, and financial stability, determining investment potential and expected ROI.

2. Pricing and Cost Decisions: Cost accounting provides detailed information on production costs, enabling management to set competitive prices without sacrificing margins. Break-even analysis helps identify sales volume needed to cover costs, guiding pricing strategies and deciding whether to adjust prices or focus on cost reduction.

3. Budgeting and Forecasting: Accounting information is essential for preparing budgets, which outline expected revenues, expenses, and financial goals over a specific period. This helps businesses allocate resources effectively, control costs, and set targets for sales, expenses, and profits.

4. Tax Planning and Compliance: Accurate accounting information is critical for preparing tax returns and ensuring compliance with tax laws. Businesses use accounting data to make decisions that minimize tax liabilities, such as taking advantage of deductions, credits, or deferrals.

5. Risk Management and Contingency Planning: Accounting information helps in identifying financial risks, such as fluctuating costs, declining profits, or high levels of debt. Businesses can make decisions about hedging, insurance, or cost control measures to mitigate these risks.

|

| Types of Accounting |

The Main Branches of Accounting and job skills and competencies

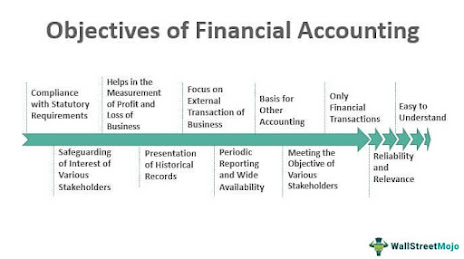

1. Financial Accounting:

focuses on creating financial statements (cash flow statements, balance sheets, and income statements) for creditors, investors, and government agencies. It follows uniform guidelines like IFRS and GAAP.

|

| Financial Accounting |

Cost Accounting:

Cost accounting is a specialised field that aids businesses in identifying, recording, analyzing, and managing production costs. It helps businesses understand their cost structure, improve efficiency, and enhance profitability. Costs are classified as direct, indirect, fixed, variable, or semi-variable.

2. Management Accounting:

Managerial accounting is a vital management tool that aids in financial decision-making through budgeting, forecasting, and cost analysis. It aids in setting financial targets, allocating resources, monitoring performance, establishing pricing strategies, improving profitability, and evaluating project profitability for sustainable growth. (Vidhya Krishnan, 2024)

Job skill sets and competencies of accounting

|

| Financial Accounting |

· Technical Accounting Knowledge:

Mastery of Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS) is critical for accurate financial reporting.

Knowledge of local and international tax laws is crucial for tax planning, compliance, and preparation of tax returns.

Familiarity with software like QuickBooks, SAP, Oracle, or Microsoft Excel for managing financial data and performing complex calculations.

· Analytical Skills:

Ability to analyze financial data, identify trends, and interpret the results to provide insights for decision-making.

Strong analytical skills are needed to troubleshoot discrepancies, resolve financial issues, and improve processes.

The ability to break down costs, assess profitability, and suggest cost-saving measures.

· Communication Skills:

Effective communication with teams across departments, auditors, and regulatory bodies.

Ability to explain complex financial data to non-financial managers and stakeholders, ensuring they understand its implications.

Clear and concise preparation of financial reports for both internal and external stakeholders. (Indeed, 2023)

Accounting systems and the role of technology in modern day accounting

Accounting systems refer to structured processes and tools used to collect, store, and manage financial data, enabling businesses to track their transactions, prepare financial reports, and ensure compliance with financial regulations. In the modern business environment, accounting systems are increasingly digitized, leveraging technology to improve accuracy, efficiency, and decision-making.

|

| modern-day accounting |

Role of technology in accounting

|

| Technology in Accounting |

· Automation of Routine Tasks:

Technology automates repetitive tasks such as data entry, transaction recording, invoicing, and reconciliations. This not only reduces human error but also speeds up processes, allowing accountants to focus on more analytical and strategic work.

Automated systems handle payroll, tax calculations, and billing, streamlining the workflow and improving accuracy.

· Real-Time Data Access:

Cloud-based accounting systems provide access to financial data in real-time from any location. This allows businesses to make timely financial decisions, monitor cash flow, and collaborate with team members remotely.

Cloud technology enables multiple users to access and work on financial data simultaneously, facilitating better collaboration between accounting teams, managers, and auditors.

· Security and Data Backup:

Cloud-based systems and other advanced technologies offer encrypted data storage, secure access controls, and two-factor authentication, safeguarding sensitive financial information.

Automated backups prevent data loss from system failures or human errors, ensuring that financial information is securely stored and recoverable.

· Mobile Accounting:

Mobile accounting apps enable business owners and accountants to manage finances from smartphones and tablets. This flexibility allows for tasks such as sending invoices, approving payments, and reviewing reports from anywhere.

Mobile solutions provide round-the-clock access to critical financial data, improving responsiveness and decision-making.

Ethics, Regulation, and Compliance in Accounting

· Ethics in Accounting:

High ethical standards enhance the credibility of accountants and the organizations they represent. This credibility is vital for attracting investors, securing financing, and maintaining positive relationships with clients and stakeholders.

Ethical conduct in accounting is essential for building and maintaining public trust in financial reporting. When accountants adhere to ethical principles, stakeholders are more likely to rely on the accuracy and integrity of financial information.

Ethics in accounting ensures adherence to laws and regulations, reducing the risk of legal issues and penalties. Ethical accountants promote transparency and accountability, which are crucial for regulatory compliance.

· Regulation in Accounting:

Regulation helps standardize accounting practices, ensuring that financial statements are prepared consistently across different organizations. This consistency is crucial for stakeholders, including investors, creditors, and regulators, who rely on comparable financial information for decision-making.

By enforcing rules and standards, regulation protects the interests of stakeholders by ensuring that financial information is accurate, complete, and free from misrepresentation. This helps prevent fraud and financial mismanagement.

Regulation creates a level playing field by ensuring that all companies comply with the same accounting standards. This prevents unfair practices and fosters competition based on performance rather than manipulation of financial results.

· Compliance in Accounting:

Compliance ensures that financial statements are accurate and reflect the true financial position of an organization. Adhering to established accounting standards reduces the risk of misrepresentation and fraud, enhancing the credibility of financial reports.

By following regulatory requirements and accounting standards, organizations protect the interests of various stakeholders, including investors, creditors, employees, and the public. Compliance helps to prevent financial mismanagement and ensures that stakeholders have access to reliable financial information.

References

Accounting, 2023. Evaluating business performance in 6 simple steps. [Online]

Available at: https://www.accountsiq.com/news/evaluating-business-performance-in-4-simple-steps/

[Accessed 24 June 2025].

Anderson, 2023. What is 'Financial accounting. [Online]

Available at: https://economictimes.indiatimes.com/definition/financial-accounting

[Accessed 24 June 2025 ].

Chirashree, 2023. What is the Role of Technology in Accounting?. [Online]

Available at: https://blog.peakflo.co/en/finance/role-of-accounting-technology

[Accessed 24 June 2025 ].

Freshbooks, 2022. Why is Accounting Important?. [Online]

Available at: https://www.freshbooks.com/hub/accounting/why-is-accounting-important?srsltid=AfmBOoohTrAZpMaddQlxnVAbNVi8iiCDskUVKjG11xYYSiexKYAVADEH

[Accessed 24 June 2025].

Indeed, 2023. 10 Essential Accountant Competencies That Employers Seek. [Online]

Available at: https://www.indeed.com/career-advice/career-development/accountant-competencies

[Accessed 24 June 2025].

Petra Martinis, 2023. Accounting Integrity and Ethics: A Comprehensive Guide. [Online]

Available at: https://dokka.com/accounting-integrity-and-ethics/

[Accessed 24 June 2025].

Scott Powell, 2023. Accounting. [Online]Available at: https://corporatefinanceinstitute.com/resources/accounting/accounting/

[Accessed 24 June 2025 ].

Smith, 2022. Introduction to Accounting. [Online]

Available at: https://www.cliffsnotes.com/study-guides/accounting/accounting-principles-i/principles-of-accounting/introduction-to-accounting

[Accessed 24 June 2025 ].

Tallysolutions, 2024. Accounting information and decision making. [Online]

Available at: https://tallysolutions.com/us/business-guides/how-does-accounting-information-help-in-decision-making/?srsltid=AfmBOooXnK8DCHQ7yVuPhlehC-M4vWByTte7GOlaiEFfSgVBjlFfw_7n

[Accessed 24 June 2025 ].

Vidhya Krishnan, 2024. Managerial Accounting – Definition, Objective, Techniques & Limitations. [Online]

Available at: https://www.zoho.com/books/academy/accounting-principles/management-accounting.html#:~:text=Managerial%20accounting%2C%20also%20called%20management,primarily%20used%20for%20internal%20purposes.

[Accessed 24 June 2025].

William, 2023. The Importance of Accounting in Our Daily Life. [Online]

Available at:https://www.accountingtechniciansireland.ie/news/how-to-apply-accounting-in-your-daily-life

[Accessed 24 June 2025].

Comments

Post a Comment